On-chain indicators report the Bitcoin to fall to $12,000. A Bitcoin price floor may be forming. The low trading volume increases the possibility of Bitcoin falling to the limit of $12,000.

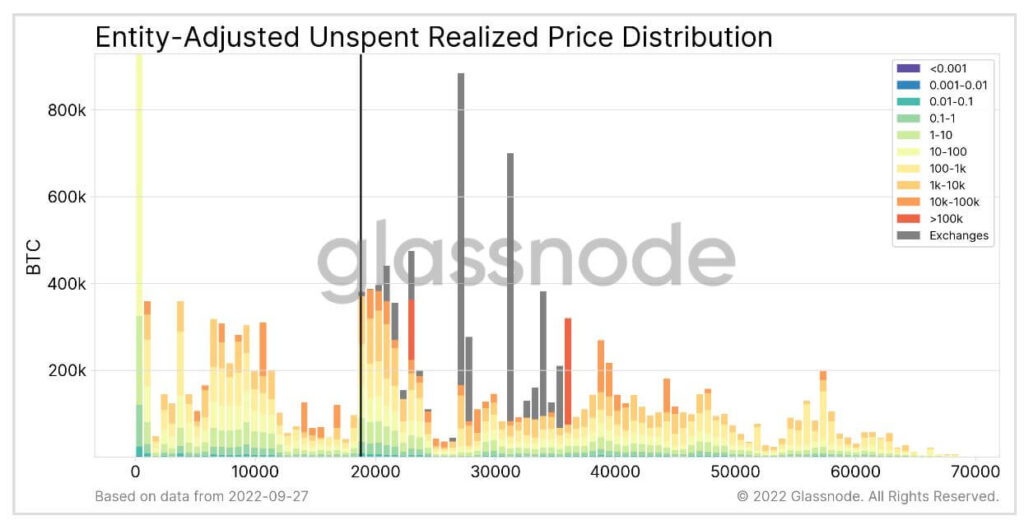

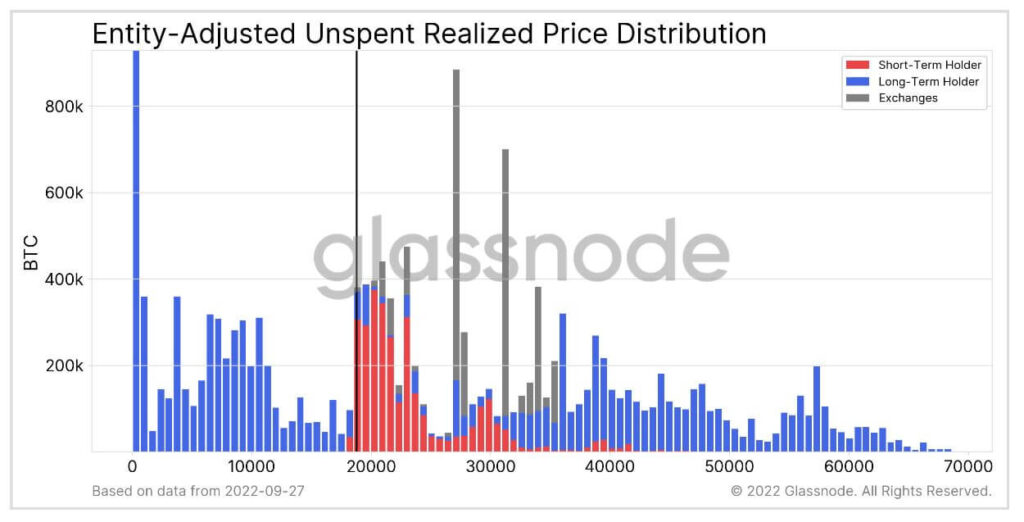

The chart below shows the adjusted version of the Unspent Outputs Realized Price Distribution or “UTXO Realized Price Distribution” by dividing the circulating supply of Bitcoin between long-term investors, short-term investors, and exchanges.

Realized price distribution index of unspent outputs by long-term, short-term investors and exchanges.

This indicator specifies at what prices the unspent outputs of current Bitcoin transactions (UTXO) were generated. The modified version of this index has made it easy to examine each group of investors and the price range of their entry into the market.

Analysis of Glassnode data shows that the majority of recent Bitcoin buyers are short-term investors. Short-term investors are those who have held their Bitcoin for less than 155 days.

Many Bitcoin whales bought their holdings in the $10,000-$17,000 range. If the price of Bitcoin falls to around $17,000, these whales are likely to sell their holdings.

Research has shown that most whales tend to sell their assets in adverse market conditions. However, selling at this point can significantly affect the price of Bitcoin.

In general, when a large deleveraging occurs in the market, low trading volume will be the biggest concern.